Hail: Facts & Statistics

Hail: Facts & Statistics

The Insurance Information Institute is an excellent resource of hail damage, hailstorm, information and statistics for the US as a whole. We found the following very interested and wanted to include it in our blog for you as well.

Hail-related insured losses between 2000 and 2019 averaged between $8 billion to $14 billion a year, according to Aon. There were 5,396 major hailstorms in 2019, according to the NOAA’s Severe Storms database. Damage caused by wind and hail cost State Farm and its policyholders more than $2.7 billion in 2018, according to a March 2019 analysis by the insurer. Colorado was the state with the most wind/hail losses, followed by Texas, Illinois, Minnesota and Missouri.

Top Five States By Number Of Major Hail Events, 2020

- Texas 6012 hail events

- South Dakota 3773 hail events

- Kansas 3414 hail events

- Oklahoma 3415 hail events

- Nebraska 313 hail events

- United States 4,611 hail events

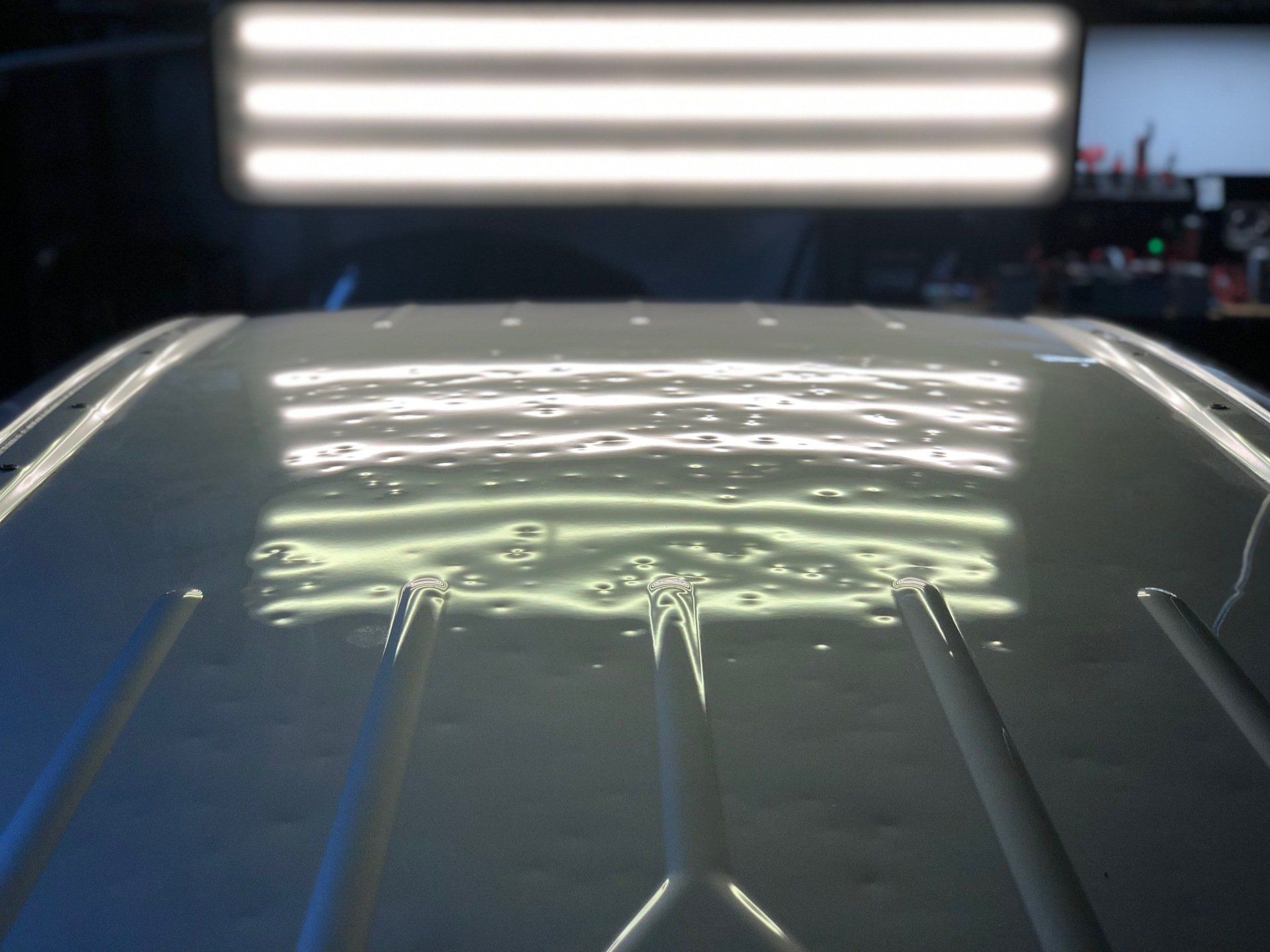

Automotive claims

A 2016 Highway Loss Data Institute (HLDI) study in the June 2016 Status Report quantified hail-related claims under automobile insurance comprehensive coverage, based on an analysis of National Oceanic and Atmospheric Administration and HLDI data for 2008 to 2014. Hail claims from 31 companies were studied, and results were based on more than 1.5 million claims. The insurers in this sample paid $5.37 billion in total hail claims from 2008 to 2014. The actual payout by all insurers was estimated by HLDI to be $7.26 billion. HLDI’s results found a frequency of 3.2 claims per 1,000 insured vehicle years during the study period and a claim severity of $3,428. 2011 had the highest claim frequency, 4.3, while 2014 had the highest claim severity, $4,169. The states with the highest claim frequencies over the years 2008 to 2014 were South Dakota and Nebraska.

Top 10 States By Highest Hail Claim Frequency, 2008-2014

- South Dakota 26.52

- Nebraska 19.1

- Oklahoma 18.4

- Kansas 16.5

- Wyoming 15.2

- Montana 11.8

- Colorado 10.0

- Missouri 9.3

- Iowa 7.6

- Texas 6.7

Verisk’s 2018 report, Hail: The Hidden Risk, says that in 2017 more than 10.7 million properties in the United States were affected by one or more damaging hail events. Verisk describes hail as damaging when the hailstones are greater than an inch in diameter. The number of properties affected in 2017 was lower than the 12.6 million properties affected in 2016 and 12.4 million in 2014, and the same as in 2015. Verisk’s latest report, U.S. Hail Damage Insights, shows that in 2019, more than 7.1 million U.S. properties were affected by one or more damaging hail events, resulting in losses of more than $13 billion. Verisk notes that the threat of hail damage has spread from the traditional “hail alley” states of Colorado, Nebraska, and Wyoming northward through the Midwest, south toward the Gulf Coast and desert Southwest, and east toward Appalachia. Underwriting may be impacted by the fact that hail damage is more common than can be measured just by claims data. Property owners may not be aware of hail damage to their roofs. In addition, hail exposure also accelerates the aging and weathering of roofs. These factors may present a risk of insurers covering pre-existing damage under a new policy.

Texas had the largest number of hail loss claims during the years 2017 to 2019, according to the National Insurance Crime Bureau’s analysis of data from ISO ClaimSearch®, with 638,000 claims. Colorado ranked second with 381,000 claims over the three years, followed by Nebraska with 161,000 claims. These three states were also ranked the top three for 2019, with 193,000 claims in Texas, 70,000 in Colorado and 57,000 in Nebraska. From 2017 to 2019 the total United States experienced 2.8 million hail claims. In 2019 hail claims totaled 785,000, down from 845,000 in 2018 and 1.4 million in 2017.

Share This Blog